04 Dec ASIC reviews Interest Free lenders. What are the takeaways?

We’ve covered the general topic of buy-now pay-later lenders before. If you’d like to read it, it’s here.

The main complaint I hear from the solar industry about interest free lenders is that claiming there is 0% interest is dishonest.

But don’t be fooled this is hardly the problem. The review was about the real issue, regulation.

Still not regulated under the National Consumer Credit Protection (NCCP)

The review has stated the lenders will NOT be subject to the NCCP.

NCCP is the regulation that in a nutshell makes sure no “unsuitable” consumer credit is handed out.

If you are subject to this, it basically means you have to make reasonable enquiries to ensure the customer can actually pay the loan. Checking credit scores, assessing income etc.

The buy-now pay-later lenders lobbied heavily against this. If they would be subject to this their whole business plan goes out the window and would most likely have to shut up shop.

There have been changes, but this was supposed to be the big one. Without regulation they can still lend to whoever they want to.

The changes

All buy-now pay-later lenders are members of AFCA now.

This means that if there are any complaints from its customers there is a 3rd party they can complain to. Similar to an ombudsman.

ASIC also now has powers to ask for more information about a product, direct the financial provider to change the way a product is designed or sold, and even ban a product.

How, when and if this will be used is not known. But now ASIC have the capability to do so.

Interesting takeaways

In all the news articles I’ve read on the issue Afterpay seems to be the one getting all the headlines.

In saying that the solar industry was closely looked at as well. In ASICs explanation of Buy now pay later arrangements, solar was it’s very first example.

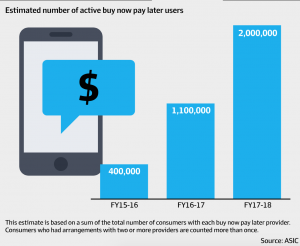

Some of the numbers were interesting too:

60% of users are aged 18-34. Which probably isn’t nearly the same for solar specifically. I would assume in solar the 65+ bracket would take up a large chunk.

30 per cent of buy now, pay later users have used more than one provider. (Once you get hooked on that drug, your hooked)

Is it right?

Let’s make it clear that buy-now pay-later lenders are all operating within the law. So in that sense they are doing nothing wrong.

But people are questioning the loophole they are using.

What I can say is that it is capitalism at its finest. If you dangle money in front of people, they will take it. Money is the most addictive drug of them all.

People addicted to this drug will borrow without concern about the future ramifications. That’s what drug addicts do.

But this issue has already been looked at carefully, and the conclusion was it is NOT the consumer’s responsibility to assess whether they can afford something. It is the lenders.

NCCP has done a decent job a filtering out bad loans. It’s not perfect. But nothing in this world is.

And after waiting a year on this ASIC review seems buy-now pay-later schemes have dodged that bullet.

So make your own judgement. Who bears the responsibility? The drug user? Or the drug dealer? Or both?

Sorry, the comment form is closed at this time.