01 Feb How is my credit score calculated (part 1)

This will be a three-part blog.

- How is my credit score calculated?

- What are the contributing factors that go towards my credit file?

- How do I get something removed from my credit file?

Before we delve into the score it is important to note that when a financier is looking at a credit file, the score is only one thing they look at.

A score of 750 vs a score of 1000 doesn’t really make that much of a difference.

It’s like having an Uber rating of 4.5 vs 4.9. Either way, the Uber driver is still going to pick you up. But if you have a rating of 3.0 then he thinks twice.

What is a good score? Anything above 750 and you’re gooooood.

500-750, you are average. Nothing to really worry about.

Below 500 is when you need to have a closer look at your file.

And that’s what financiers look at, the file as a whole. They look at contributing factors that go towards the score.

If anything the “score” is not a perfect science yet. So it sometimes not even used at all.

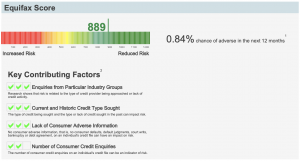

The algorithm used to calculate the score exactly is a mystery. Equifax is the main company that everyone uses in Australia. They essentially have a monopoly on the market.

Equifax’s scoring algorithm is their proprietary knowledge, like Google’s algorithm.

There are other players, but not many. For this series we will be focusing on Equifax only.

So, scores can vary between -200 and 1200.

A score of -200 represents a 1:1 chance (50%) that the applicant will default.

For every 100 points above this the odds double, so e.g. -100 would represent 2:1 chance (33.3%).

The contributing factors that go towards calculating your score are what we will take a deep dive into next week. They include:

- Credit Enquiries

- Defaults

- Court Writs / Actions

- Accounts and Repayments

Again we don’t know the exact mathematics, but generally the more of the above you have, the worse your score will be.

There are other parts to credit files but these are the main ones. We will also only be focusing on personal credit files, not commercial ones.

Sorry, the comment form is closed at this time.