01 Feb How is my credit score calculated (part 2)

Last week we covered what your credit score means and what factors contribute towards it.

This month we will take a deep dive into each of those factors.

Credit Enquires

This is any time you have enquired about credit. Or more specifically when someone has gone into your credit file. Below is all the information is shows.

A credit enquiry is not necessarily a bad thing. Someone with zero credit enquires would be considered a fraud risk.

Also not only lenders go into your credit file, all sorts of companies do.

If you are doing business with a distributor they might go into your file. If you are getting a PPA from a retailer, they might go into your credit file. If sign up to a mobile phone plan they will go into your credit file.

The type and frequency of your credit enquires are what affects your credit score.

For example, if you have 5 credit enquires from 5 different car finance companies in a month, it might indicate that you are getting declined over and over again, and you are trying again and again. Therefore decreasing your credit score.

Or another example is if you have an enquiry from a payday lender….

Side note, a payday lender is a that specialises in small term and size loans. Like $2,000 over 6 months.

….If you had an enquiry from a payday lender, one could assume that you have cash flow problems. If you can’t manage $2,000 that doesn’t make a financier feel good about lending you even more money.

Defaults

Unlike credit enquires, default are always bad news. If you’ve been given credit by someone and not paid them back, they can list the amount you owe them here.

The only companies that can list defaults are those who are subscribed to Equifax. So you generally won’t see smaller companies listed here. Only ones who deal with defaults on a regular basis.

People often have the misconception that once a default is paid it is to be “removed” from your credit file.

Once a default is listed on your file, it isn’t going anywhere for 5 years.

The only thing that changes if you pay the debt is the status. It can either be “Outstanding” or “Paid”.

Obviously “Paid” is better than “Outstanding” but it’s still not a good look that it got there in the first place.

Defaults will bring your credit score down dramatically. The newer and larger they are, the more of an impact they’ll have.

The only defaults that may be overlooked by lenders are telco defaults. E.g. Telstra, Optus etc. This is because they are known for defaulting customers for the smallest of amounts, and very quickly too.

Although no default is still better than a telco default.

Court Writ / Actions

If someone takes you to court, it will be listed as a court writ.

If a judgement is made, it will be listed as a court action.

Equifax relies on the courts to provide them information about writs and action and like any government organisation they have the tendency to be unreliable.

That’s why sometimes you may not always see up to date information listed here. This can work in your favour and against.

Sometimes a court action will happen and it will never be listed on your credit file.

Sometimes you’ll be summoned to court and immediately the case will be dismissed, but the writ remains on your credit file.

Lenders usually want to know the story behind a court writ, as if it was a dispute amongst businesses, you potentially are not at fault.

There is not as much leeway on a court action though as the judgement has already been made.

As for your score, both do not help. Like defaults they remain there for 5 years before being lifted.

Court Writ information is only held for QLD & WA. Lucky for the rest. Court Action information is held for all states.

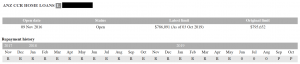

Accounts and repayments

This is a relatively new addition to credit reporting in Australia.

Now you can see your account conduct on credit contacts you have entered into, as long as the credit provider has subscribed to the service.

That means if the credit provider gives Equifax information on repayment history, they in turn get to view repayment history on other credit contracts.

If they do not share information, they do not get to see this.

I was going to go into detail about what the letters and numbers mean on the picture above. But to be honest, it won’t provide you any value.

The thing to focus on is, they now know if you are not paying. The more you are overdue, the worse it’ll look and the more it’ll bring down your score.

I’ve seen people with credit cards at zero balances get bitten on this. They forget to pay the annual fee for a few months and all of a sudden it looks like they are 2-3 months overdue on their credit card. Which is a very bad look.

Sorry, the comment form is closed at this time.